utah state tax commission property tax division

Utah State Tax Commission Property Tax Division 210 North 1950 West Salt Lake City UT 84134-3310 801-297-3600 1-800-662-4335 Fax. Contact us by phone click on the Phone tab above for numbers.

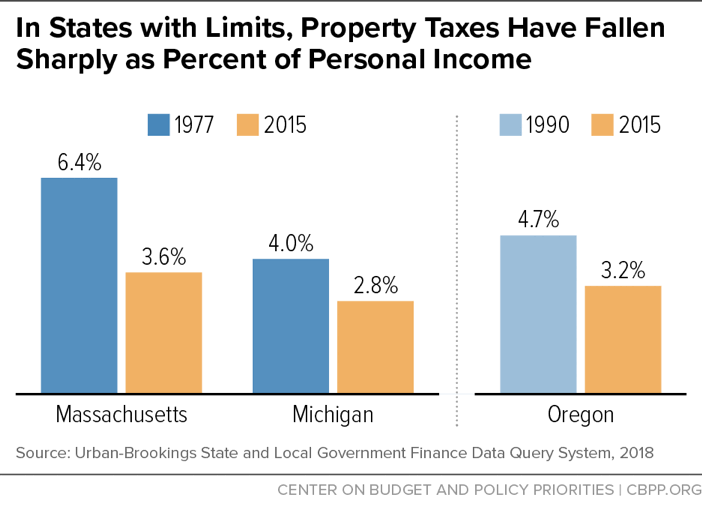

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

The Governor with consent of the Senate.

. It does not contain all tax laws or rules. Please contact us at 801-297-2200 or. Property Tax Division Series 9955 is the assessment system.

Property Tax Division Series 2496 record the final assessments. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530. Property Tax Division Records Officers.

Public utility and natural resources recapitulations. Utah State Tax Commission. Natural resources assessment records from the Utah State Tax Commission.

For more information email. Property tax assessment system from the Utah State Tax Commission. Purchasers may provide a seller an.

Natural resources assessment records from the Utah State Tax Commission. Return completed form to the Centrally Assessed Property Tax Division 210 North 1950 West Salt Lake City UT 84134. Master File 210 North 1950 West Salt Lake City UT 84134-3310 Fax.

Assessors returns of mining companies. Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake. Fax to 801-297-3699 or email natres-proptaxutahgov or.

Fax to 801-297-3699 or email natres-proptaxutahgov or. Property Tax Division Series 2496 give the final assessments of property based in part on a multiple of the. Property Tax Division Series 2480 show the property holdings and valuations submitted by the companies which.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. The Utah State Tax Commission created in 1931 consists of four members not more than two of whom may belong to the same political party. The following information will help you understand the audit and appeal process of the Utah State Tax Commission.

Religious and Charitable Section Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134-3212 What is an exemption certificate. Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often. Public utilities property tax returns from the Utah State Tax Commission.

File electronically using Taxpayer Access Point at. Utah State Tax Commission Attn. For security reasons TAP and other e-services are not available in most countries outside the United States.

Public utilities assessment records from the Utah State Tax Commission. Return completed form to the Centrally Assessed Property Tax Division 210 North 1950 West Salt Lake City UT 84134. Contact information for individuals filling record-keeping roles in this agency are available.

Sales Taxes In The United States Wikipedia

Tangible Personal Property State Tangible Personal Property Taxes

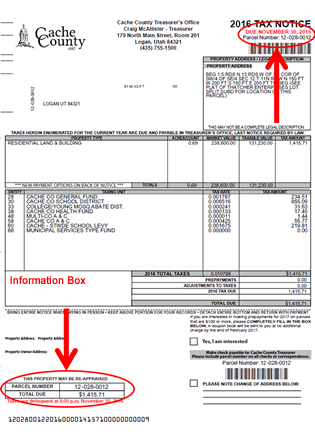

Official Site Of Cache County Utah Paying Property Taxes

Property Valuation Notice Utah County Clerk Auditor

Lease Agreement Fill Online Printable Fillable Blank Pdffiller

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Pay Taxes Utah County Treasurer

Property Taxes When To Consider An Appeal Choose Park City Luxury Real Estate Agents

Sales Tax Amnesty Programs By State Sales Tax Institute

Utah Sales Tax Small Business Guide Truic

Property Taxes Went Up In These Utah Cities And Towns

Working At Utah State Tax Commission Glassdoor

Property Tax Utah State Tax Commission Utah Gov

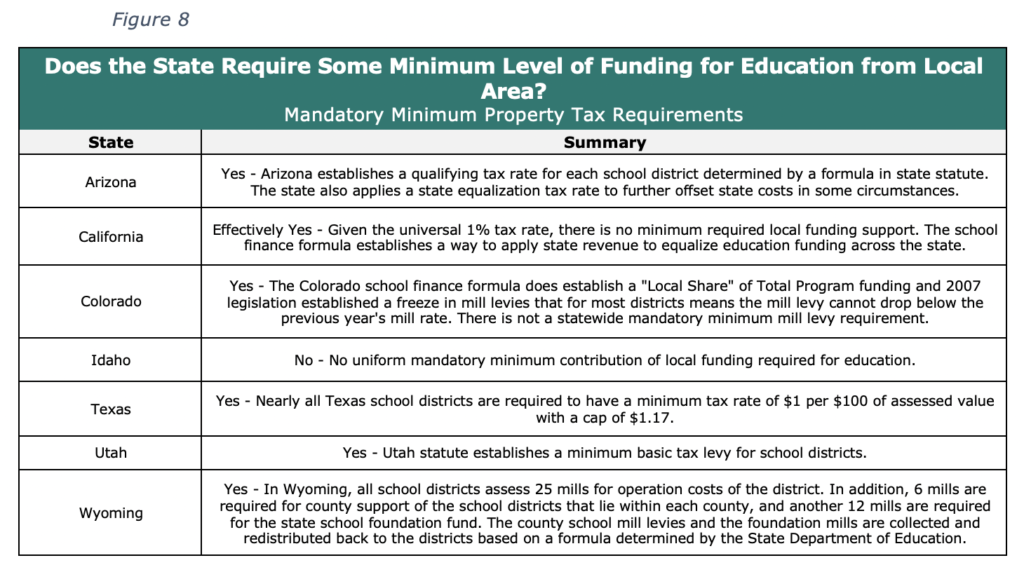

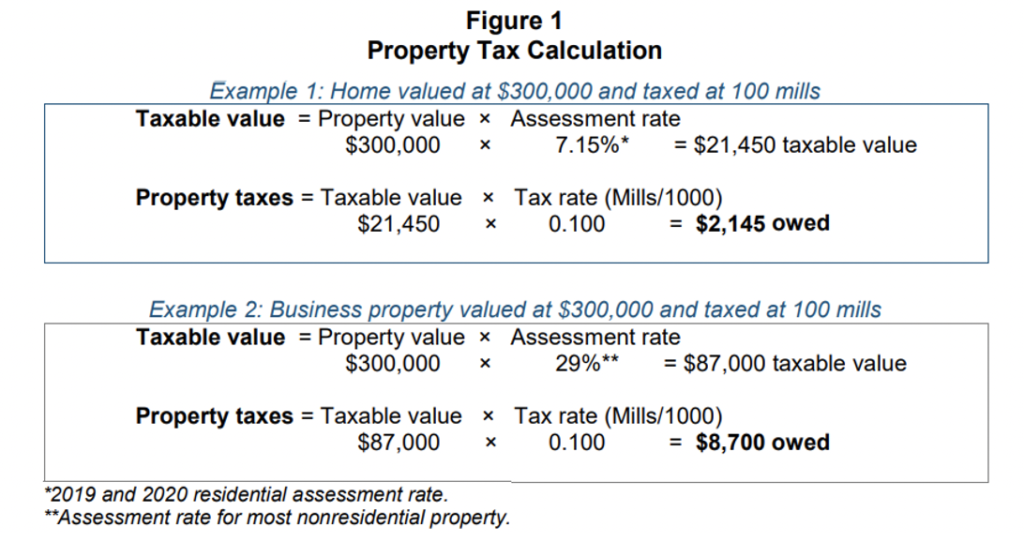

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

State Taxation As It Applies To 1031 Exchanges

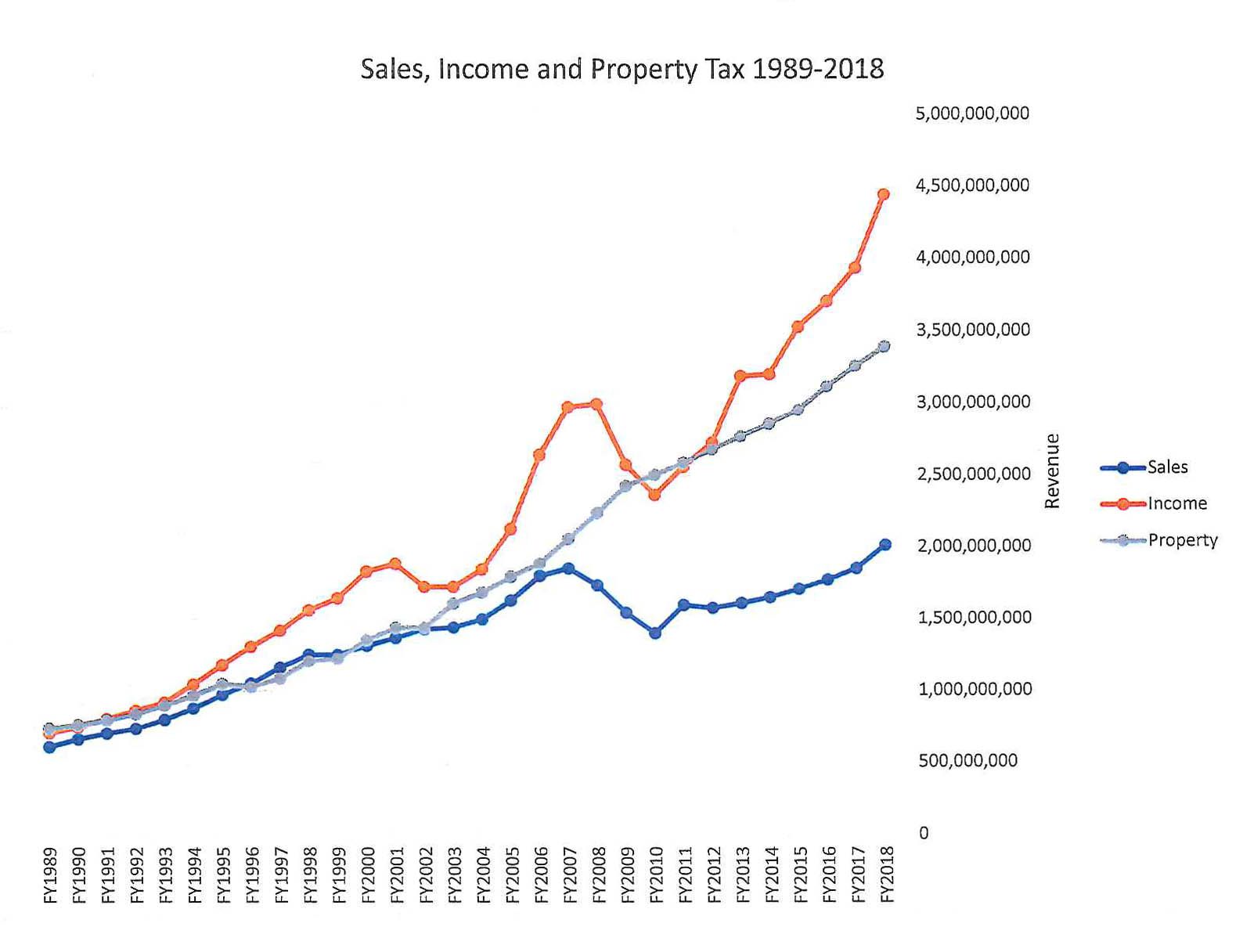

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute